asset growth of islamic finance decline malaysia

In particular the country has launched 190 Islamic Unit Trust Funds with the total net asset value NAV of RM 4899 bln or USD 1135. Financing provided by Islamic subsidiaries also grew.

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Islamic finance growth prospect Malaysia.

. Turkey and Iran lead the decline and the trend seems likely to continue for the next 12-24 months. It should be noted that given the recent growth of the global Islamic finance market publicly available data is relatively scarce and difficult to verify. It has tremendous potential to grow further in.

Equity fund assets are declining as money market fund assets grow. The total value of Islamic AuM in Malaysia as per June 2015 was RM 11740 bln or approximately USD 2720 bln representing 179 market share of the total AuM industry in Malaysia. The asset growth of Islamic subsidiaries stood at 129 percent in 2015 albeit with a drop of 15 percent from 2014 way above stand-alone banks assets growth of 84 percent and 58 percent in the corresponding years.

Innovation in Islamic banking is not just limited to technological progress however. Malaysia Bahrain and the UAE again led the 131 countries assessed in terms of the Islamic Finance Development Indicator score which aggregates indicator scores for Quantitative Development. Islamic equity fund AUM as a percent of all Islamic funds has shrunk to 58 from 64 in 2015.

Islamic finance is projected to continue to expand in response to economic growth in countries with large and. An Overview of Islamic Finance. Islamic finance is a form of financing in which all transactions must comply with sharia Islamic rulings which is a broad term used for a system of beliefs revealed in the Holy Quran and the Sunna.

93 outpacing that of conventional bankings 33 underpinned by the banks sustained Islamic First strategy where banks offer new customers Islamic products over conventional ones and a supportive regulatory environment. The pandemic has got a dent in the growth of the Islamic Finance market. We expect the slowdown at Islamic banks in the GCC will persist in 2017 after asset growth declined to 53 per cent in 2016 from 107 per cent in 2014.

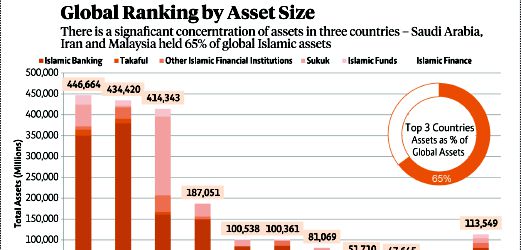

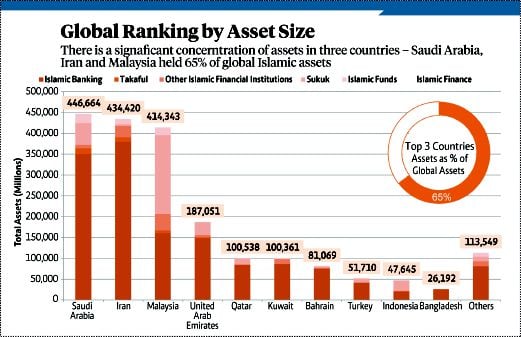

Saudi Arabia and Malaysia remain the largest Islamic finance markets in terms of assets while Cyprus Nigeria and Australia saw the most rapid growth. Role of Sukuk in Development Finance Sukuk is an alternative Islamic finance instrument for conventional bonds. We believe that cultivating Islamic finance digital capabilities is essential to propel the growth of Shariah investing and attract new participants to Malaysias Islamic capital market Datuk Syed Zaid added.

It is estimated that the size of the Islamic banking industry at the global level was close to 820 billion at end-2008. This Asia Focus report explores the topic of Islamic finance and highlights Malaysias role in developing the Islamic finance market. INTRODUCTION Islamic finance has grown rapidly over the past decade and its banking segment has become systemically important in a dozen countries in a wide range of regions.

SP global ratings expects Islamic finance industry USD 24trillion to witness subdued growth in low single digits for 202021 after registering strong growth of. Since their development over 1400 years ago the key principles of Islamic finance have broadly remained unchanged. Malaysia Indonesia and the Gulf Co-operation Council countries were among the few sources of industry growth.

Experts predict a slowdown in the growth of the industry a decrease in profitability and potentially a decline in the quality of assets. Although the Malaysian economy suffered from a recession in 2001 and 2009 the assetscapital of the Islamic financial system grew significantly over the period 20082009 from RM18bn in 2008 to RM24bn in 2009 representing an increase of over 76 Bank Negara Malaysia 2017. Amid the rapid growth of the industry globally Malaysia has been at the forefront with total Islamic asset accounting for nearly 13 of the global Islamic finance industry and 8 of the global Islamic banking assets Ernst and Young 2013 SESRIC 2012.

Sukuk is one of the worst hit segments and will be in the slump of slow trend. This article was first published in Islamic Finance news Volume 17 Issue 41 dated the 14th October 2020. According to Shariah the Islamic mode of finance should emphasize profit and loss sharing and.

In our base-case scenario we assume that asset growth will stabilise at about five per cent as governments spending cuts and revenue-boosting initiatives such as new taxes reduce Islamic banks. Subsidiaries have overwhelmingly outperformed stand-alone Islamic banks. INTRODUCTION Islamic Finance is governed by the Shariah Islamic Law sourced from the Quran and the Sunnah which are followed by the consensus of the jurists and interpreters of Islamic law.

Islamic law does not permit interest and hence conventional coupon paying bonds are impermissible as per Islamic law. The main reason being the longer regularization process of Sukuk made many choose regular bonds to raise money during the Pandemic. Islamic banking is expected to remain resilient in 2022 and record growth in financing on the back of an improved economic environment and substantial public demand for Islamic products.

In some countries it has become systemically important and in many others it is too big to be ignored. Sukuk is a certificate that represents ownership in underlying real assets. Malaysias A-Stable Islamic banks financing grew by 11 in 2018 2017.

At the domestic front the Islamic banking asset stood at US125 billion in 2012 equivalent to 20 of the countrys. Fitch Ratings associate director for banks Priscilla Tjitra and Global head of Islamic Finance Bashar Al Natoor stated the sectors growth will pick up modestly in 2022 as. Secular trends underline long-term growth for Islamic asset management.

The growth of banking assets has slowed in almost all core Islamic finance markets. The Islamic finance industry has expanded rapidly over the past decade growing at 10-12 annually. Asset financing is also playing an important role.

SCxSC 2021 will focus on Islamic Fintech and Regtech. During the same period Islamic money market funds have grown to 32 from 26. Today Sharia-compliant financial assets are estimated at roughly US2 trillion covering bank and non-bank financial institutions capital markets money markets and insurance Takaful.

Covid-19 pandemic and tumbling oil prices hamper Sukuks growth. Fitch Ratings Perspective. Islamic finance is one of the fastest growing segments of the global financial industry.

The International Monetary Fund noted in 2015 that Islamic finance assets had seen double digit growth between 2003 and 2013 from 200bn to around 18 trillion. We expect the slowdown at Islamic banks in the GCC will persist in 2017 after asset growth declined to 53 in 2016 from 107 in 2014. Malaysia has recorded 173 growth of Islamic finances market between 2009 -2014 MIFC 2015a.

Islamic finance is developing predominantly in Muslim-majority countries most importantly in Malaysia GCC and Iran. ISLAMIC FINANCE 8 INTERNATIONAL MONETARY FUND I.

Malaysia Bank Islam Assets Financing Advances Other Loans Economic Indicators Ceic

Malaysia Seen Within Reach Of 40 Islamic Financing Target The Edge Markets

Rise In Islamic Banking Assets

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Moody S Downgrades Malaysia Banking System Outlook To Negative Banking Malaysia Investment Banking

Credit Of Conventional And Islamic Banks In Malaysia Sources The Download Scientific Diagram

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

0 Response to "asset growth of islamic finance decline malaysia"

Post a Comment